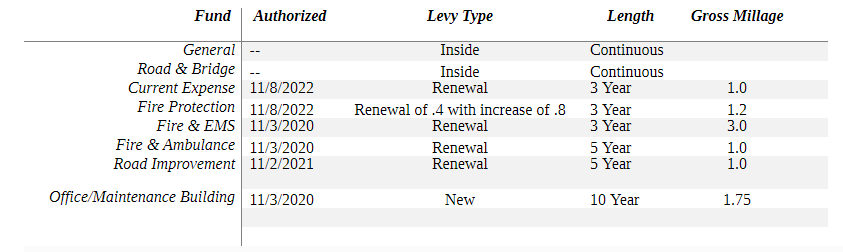

Freedom Township Property Tax Levies/Millage

Freedom Township does not receive income tax. Funds received by the Township come primarily from Property tax but it receives additional funding from sources such as gas tax and motor vehicle license tax. Below is a chart of levied funds.

What is a Levy

A tax levy is a formula that calculates the amount of tax collected by a local government. A levy directs the amount of tax collected in accordance with Ohio law. A township, for instance, operates with separate funds for particular costs specific to the township.

What is a Mill

A levy is calculated using mills. A mill is equal to $1 of tax for every $1,000 of Assessed Value. The Auditor uses fair market value to determine a property's assessed value, which in Ohio amounts to 35% of the fair market value. For example, a home with a fair market value of $100,000 would have an assessed value of $35,000 ($100,000 x 0.35). Therefore, a 1 mill levy would cost the owner of a property Appraised at $100,000,

$35. Annually for the life of the levy

There are 2 types of mills. Inside mills are established by the state and are not voted on by the residents of the Township. Outside mills are authorized by the taxpayers by a vote. The voting ballots contain specific language relating to each proposed levy and the purpose for the anticipated expenditures.

In addition, a levied fund can run in perpetuity, but typically levies operate for a limited amount of time such as three or five years. After that, the levy will need to be renewed or replaced.

Property tax is collected in arrears so the taxes collected for 2021 are paid in 2022. The list below explains the property tax levied funds for Freedom Township beginning January 2023:

For more information on taxes and how they work, follow the link to the Wood County Auditor’s Site here.